Banks are under increased pressure to undergo digital transformation to meet customer demands and stay competitive. While investing in innovative tools and technologies that facilitate a secure, frictionless user experience is critical, your website’s content also has to be a part of the digital transformation equation.

Meet The Needs Of Always-Connected Customers

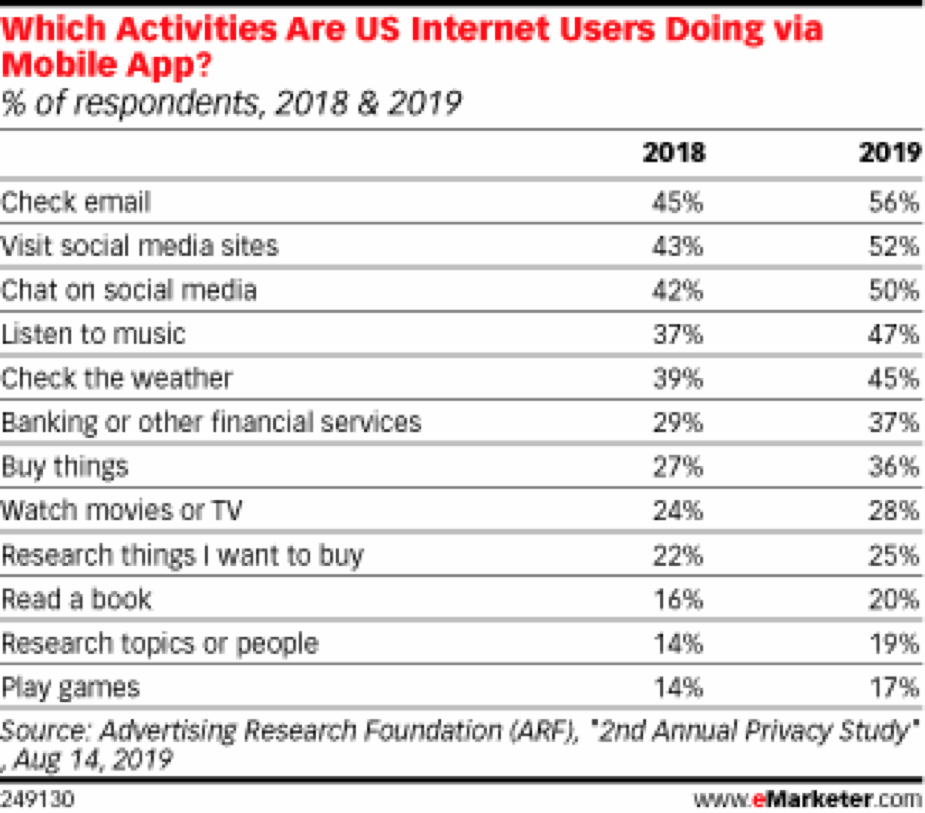

Digital transformation helps consumers do more DIY banking. It is what users want and expect. An Advertising Research Foundation study found that 37% of U.S. internet users are banking and accessing other financial services via a mobile app, with 46% using a desktop or laptop.

Thirty-seven percent of U.S. internet users are banking via mobile app and forty-six percent are banking via desktop/laptop; eMarketer.

The Verint ForeSee Digital Experience Index Q1 2019 survey report which looked at banking and the digital experience and customer satisfaction, pointed out that banking is omnichannel. Banks need to meet the digital needs of customers at every touchpoint, online and at the branch, whether it’s through a digital banking app, a payment app, or a chatbot.

The Verint survey ranked banks in terms of visitor satisfaction with their online banking experience. One of the factors that had the greatest positive impact on satisfaction was site information. In other words, content.

Content Must Support Your Technology

Digital transformation drives efficiency and profits. But while a digitally-focused bank may be able to expand its product offerings, offer more competitive rates, and facilitate the processing of applications and transactions, technology can’t exist in a bubble. It needs content to support and optimize it.

If consumers do not understand how to access your new features or use a platform to their advantage, you may see underwhelming results from your digital transformation. Good content complements your technology and can help ensure that your customers are truly reaping all the benefits your financial institution has to offer.

One of the factors that had the greatest positive impact on satisfaction was site information. In other words, content.

Is Your Content Doing What It Should?

Does your content fulfill the demands of these digitally-savvy consumers? Content that includes the following can guide users through their journeys, give them confidence about their choices, and help them make the most out of the banking tools and technologies available to them:

Clear directions on how to use online and mobile banking tools and apps, apply for loans, open an account, reach customer service, etc. Advanced technology is not helpful if your users are unsure of how to access and use it to their benefit. The Verint report found that the top-rated banking sites had “goal-oriented landing pages” and provided simple access to account balances, transfer money. The pages also have “orientation cues” such as prominent titles and breadcrumb trails that help users understand where they are within the site’s structure.

Messaging about security. A recent EmailMarketing Daily article discussed “Inside the Lifecycle of the Financial Services Consumer,” a study conducted by Yes Marketing that found that 22% of consumers want financial services providers to “proactively communicate” that personal information will be secure. Keep this in mind as your consumers may have increasing security concerns as they shift more of their banking to mobile apps.

Detailed descriptions of bank products and services. A digital transformation can mean new products and services, more competitive rates, and additional upsell and cross-sell opportunities. Make sure your product and services page content is compelling and has clear calls-to-action to capture prospective customers.

Consider being straightforward about rate and fee information. The Yes Marketing study also found that 57% of respondents said upfront information about “services, rates, and fees up” instills trust with a financial institution.

Digital transformation is changing the way banks do business. But you must still connect with humans. The right content enhances the user experience from the moment a person lands on your website. If your bank has undergone a digital transformation, it is important to have a solid content marketing strategy that can help you capitalize on your digital transformation investment and increase your sales and profits.

Responses